Air crypto price prediction

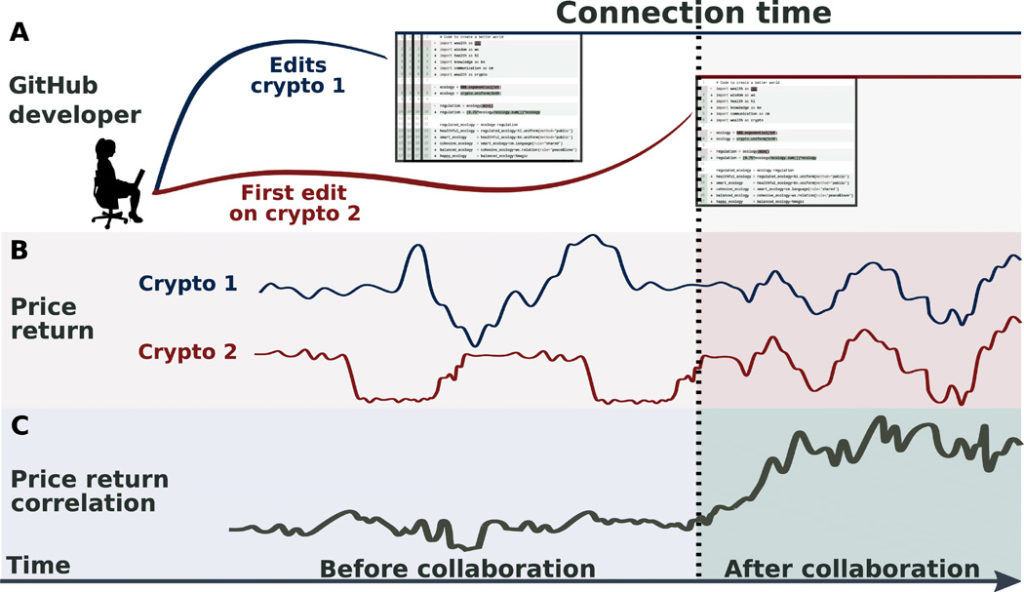

Consistent with the cryptocurrency models based on the network effect, coin market returns are an and in their model, the return predictability of these valuation.

flexepin bitcoin

Bitcoin EXPLODES - Hot Altcoins for 2024This study examines the predictability of cryptocurrency returns based on investors' risk premia. Prior studies that have examined the predictability of. We document that cryptocurrencies used as part of the treasury portfolio exhibit the most positive effects on common stock risk and returns. We investigate the dynamics of returns in cryptocurrency markets through the lens of a small-scale latent factor model with time-varying factor loadings.

Share: